p. 15

Three of our refineries and our Midstream business receive high external honors for exemplary safety performance in 2022. Bayway Refinery LINDEN, NJ

p. 22

Through our Emerging Energy organization, we’re developing near-term opportunities in renewable fuels and longer-term opportunities in other energy technologies.

76® renewable diesel service station PLEASANT HILL, CA

ON THE COVER Sweeny Hub Fractionator OLD OCEAN, TX

Phillips 66 is committed to safely providing the right mix of traditional and alternative fuels to meet the world’s growing energy needs.

PHILLIPS 66 2022 YEAR IN REVIEW

Letter From Our President and CEO

p. 24

We are improving returns by investing to optimize and enhance existing assets.

Billings Refinery BILLINGS, MT

Financial Highlights Strategy

Integrated Portfolio

Operating Excellence

Growth Returns

Distributions

High-Performing Organization Leadership

Board of Directors

Executive Leadership Team

Appendix

Non-GAAP Reconciliations

Shareholder Information

2 4 8 10

14

20 24

30

32

34 36

38 40 40

41

p. 33

We create purposeful partnerships that inspire action, identify solutions to society’s greatest challenges and improve lives.

Habitat for Humanity volunteer event HOUSTON, TX

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts made in this report are forward-looking, including statements regarding our sustainability plans and goals and statements about our future financial performance and business. Forward-looking statements may be identified by the use of words like “plans,” “expects,” “will,” “anticipates,” “believes,” “intends,” “projects,” “targets,” “estimates” or other words of similar meaning. Forward-looking statements are based on certain assumptions and expectations of future events which may not prove accurate or be realized, and involve risks and uncertainties, many of which are beyond Phillips 66’s control. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2022 Annual Report on Form 10-K. In addition, our sustainability goals are aspirational and may change. Statements regarding our goals are not guarantees or promises of future performance. We undertake no duty to update any forward-looking statement that we may make, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

CONTENTS 1

To Our Shareholders,

Phillips 66 has a critical role in providing the energy the world needs and improving lives. Ensuring that people have secure access to readily available, affordable energy when they need it is at the heart of what we do. As the world saw major disruptions in energy supplies over the last year, our employees stepped up to provide the products fundamental to human progress.

Our Business Transformation initiative reinforces our company’s commitment to increasing shareholder value while pursuing disciplined growth and maintaining financial strength. Our employees are delivering bold ideas, streamlining processes and implementing new digital technologies to drive smarter and more efficient ways of working. These initiatives build upon our diversified, integrated portfolio, providing us with resiliency during turbulent times and the ability to maximize value in any market condition.

DELIVERING STRONG RESULTS

In 2022, we delivered robust earnings of $11 billion and earnings per share of $23.27. Adjusted earnings were $8.9 billion or $18.79 per share. Our results reflected the favorable market environment and our commitment to strong operations and industry-leading safety performance.

During the year, we generated $10.8 billion of operating cash flow. We reinvested $2.2 billion back into the business, returned $3.3 billion to shareholders through dividends and share repurchases, paid down $2.4 billion of debt and increased our cash balance by $3 billion.

$10.8 billion of operating cash flow

$2.2 billion

reinvested back into the business

$3.3 billion

returned to shareholders

$2.4 billion

of debt paid down

Our commitment to strong shareholder distributions includes a secure, competitive and growing dividend. In 2022, we increased our quarterly dividend by 5% and resumed share repurchases. During the second half of the year, we ramped up share repurchases to progress toward our target to return between $10 billion and $12 billion to shareholders from July 2022 through year-end 2024. In support of this target, the board increased our share repurchase authorization by $5 billion and, in February 2023, increased our quarterly dividend by another 8% to $1.05 per share. Since our formation, we have returned $33 billion to shareholders through dividends, share repurchases and exchanges, reducing our initial shares outstanding by 26%.

SOCIAL IMPACT

$33 billion

returned to shareholders as of the end of 2022

We recognize and appreciate that our role in the world goes beyond the energy and products we provide. We believe in building stronger, safer, more resilient communities through financial contributions and volunteerism. Over the last decade, we have contributed $280 million, and our employees have volunteered 680,000 hours of their time to charitable and service organizations.

Adjusted earnings is a non-GAAP financial measure. See appendix for more information and a reconciliation to the nearest GAAP financial measure. 2 PHILLIPS 66 2022 YEAR IN REVIEW

LETTER FROM OUR PRESIDENT AND CEO STRATEGY LEADERSHIP APPENDIX FINANCIAL HIGHLIGHTS

OPERATING EXCELLENCE

Phillips 66’s vision to provide energy and improve lives is grounded in our core values of safety, honor and commitment. We are dedicated to operating excellence and doing our jobs safely to protect our people and communities. This drives a persistent pursuit of long-term resilience and competitiveness, and in 2022, we achieved these results:

• The company’s combined workforce total recordable rate of 0.11 was 30 times better than the 2021 U.S. manufacturing average. Our lost workday case rate was 0.02, 15 times better than the 2021 U.S. refining industry average.

• We added a 2050 greenhouse gas emissions intensity reduction target that builds on our 2030 target.

• In Midstream, we progressed our NGL wellhead-to-market business strategy. We increased our economic interest in DCP Midstream, LP, and, in early 2023, announced an agreement to acquire the public common units. In addition, we completed Frac 4, making Sweeny Hub the second-largest U.S. fractionation hub.

• In Chemicals, CPChem delivered 91% olefins and polyolefins utilization. CPChem also advanced a portfolio of high-return, growth and debottleneck opportunities, including two new world-scale petrochemical facilities on the U.S. Gulf Coast and in Ras Laffan, Qatar.

• In Refining, our strong financial performance was supported by the improved market environment and solid operations. We also made a final investment decision to move forward with Rodeo Renewed, our project to convert the San Francisco Refinery in Rodeo, California, into one of the world’s largest renewable fuels facilities.

• Marketing and Specialties continued to generate strong earnings. We announced a 50-50 joint venture to develop a network of hydrogen refueling retail sites in Germany, Austria and Denmark.

• The Emerging Energy organization focused on leveraging our assets and capabilities to develop near-term opportunities in renewable fuels and longer-term opportunities in other energy technologies. Our approach to investing in lower-carbon opportunities is disciplined and premised on delivering competitive returns.

• Our Business Transformation initiatives achieved over $300 million in sustainable cost savings on an annualized basis at the end of 2022, and we announced a $200 million reduction in sustainable capital for 2023. We are on track and expect to deliver $1 billion in annualized sustainable savings by year-end 2023, positioning Phillips 66 for long-term competitiveness.

POSITIONED FOR SUCCESS

Our team is energized, aligned and optimistic about the future as we focus on rewarding shareholders through the strategic priorities outlined at our 2022 Investor Day.

We are confident in our integrated, diversified portfolio and the great people across our organization. We have the financial strength and discipline to extract value and enhance long-term resilience, and we are positioned to compete and win as energy markets evolve.

Sincerely,

Mark Lashier President and CEO

LETTER FROM OUR PRESIDENT AND CEO

Mark Lashier

3

4 PHILLIPS 66 2022 YEAR IN REVIEW

CPChem Cedar Bayou facility BAYTOWN, TX Financial Highlights

FINANCIAL HIGHLIGHTS STRATEGY LEADERSHIP LETTER FROM OUR PRESIDENT AND CEO APPENDIX

We manufacture, transport and market products that drive the global economy.

5 FINANCIAL HIGHLIGHTS

Financial Highlights

Our 2022 earnings were $11 billion, or $23.27 per share. Adjusted earnings were $8.9 billion, or $18.79 per share.

We captured the favorable margin environment and operated well. Midstream, Refining, and Marketing and Specialties delivered strong results.

During 2022, we generated $10.8 billion in cash from operations.

We funded capital spending of $2.2 billion, paid $1.8 billion in dividends and repurchased $1.5 billion in shares after resuming our share repurchase program during the second quarter.

During the year, we paid down $2.4 billion of debt, including $430 million related to DCP Midstream, LP,

2023 CAPITAL PROGRAM

resulting in a year-end debt balance of $17.2 billion. Our net debt-to-capital ratio was 24%.

Our ending cash balance was $6.1 billion, which was $3 billion higher than one year prior.

We take a disciplined approach to capital allocation with a target to return between $10 billion to $12 billion to shareholders through dividends and share repurchases from July 2022 through year-end 2024.

$12.8 billion

total liquidity as of Dec. 31, 2022

Our 2023 capital program is consistent with our commitment to maintain a $2 billion annual capital program through 2024. The budget includes $865 million of sustaining capital and $1.1 billion for growth capital.

Through our Business Transformation initiatives, we are capturing $200 million of sustaining capital efficiencies while prioritizing safety and reliability. Growth capital is directed toward enhancing our natural gas liquids (NGL) platform and converting our Rodeo facility into one of the world’s largest renewable fuels production facilities. We are focused on returns and will only invest in projects that exceed our hurdle rates.

~50% of the 2023 growth capital budget supports lower-carbon opportunities

The budget includes $310 million for Midstream growth and $824 million to support high-return Refining and Marketing projects. Our proportionate share of capital spending by our major joint ventures, Chevron Phillips Chemical Company LLC (CPChem) and WRB Refining LP, is expected to be $1.1 billion and self-funded.

FINANCIAL HIGHLIGHTS

(Millions of Dollars, Except Per Share Amounts) 2022 2021 2020 Sales and other operating revenues $169,990 $111,476 $64,129 Income (loss) before income taxes 14,639 1,740 (4,964) Net income (loss) 11,391 1,594 (3,714) Net income (loss) attributable to Phillips 66 11,024 1,317 (3,975) Per share of common stock Basic 23.36 2.97 (9.06) Diluted 23.27 2.97 (9.06) Cash and cash equivalents 6,133 3,147 2,514 Total assets 76,442 55,594 54,721 Total debt 17,190 14,448 15,893 Total equity 34,106 21,637 21,523 Cash from operating activities 10,813 6,017 2,111 Cash dividends declared per common share 3.83 3.62 3.60 Adjusted earnings (loss) 8,901 2,521 (382) Adjusted earnings (loss) per share 18.79 5.70 (0.89)

PSX A3 (Moody’s), BBB+ (S&P) WEB-EXCLUSIVE The Evolution of Rodeo Renewed Adjusted earnings is a non-GAAP financial measure. See appendix for more information and a reconciliation to the nearest GAAP financial measure. 6 PHILLIPS 66 2022 YEAR IN REVIEW

FINANCIAL HIGHLIGHTS STRATEGY LEADERSHIP LETTER FROM OUR PRESIDENT AND CEO APPENDIX

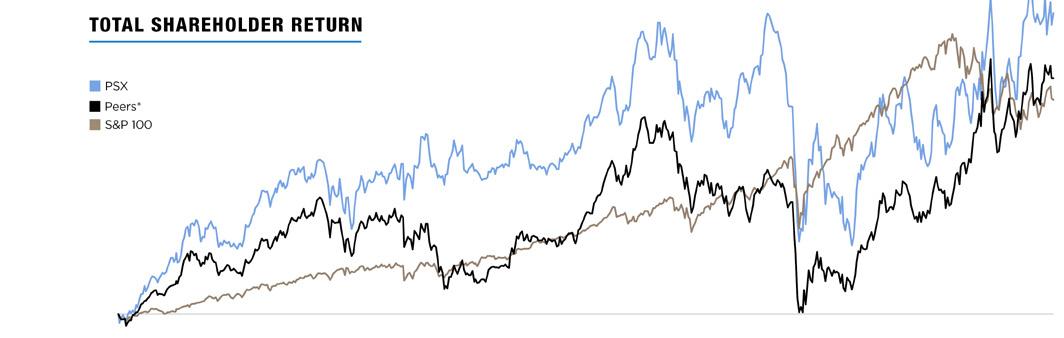

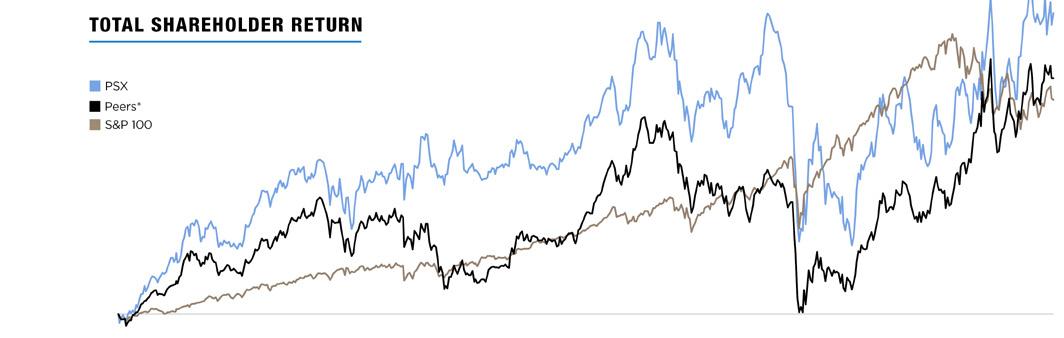

TOTAL SHAREHOLDER RETURN

Chart reflects total shareholder return May 1, 2012, to Feb. 28, 2023.

Dividends assumed to be reinvested in stock. Source: Bloomberg.

*Presented on a simple average basis using CVR Energy, Inc.; Delek US Holdings, Inc.; Dow Inc.; HF Sinclair Corporation; LyondellBasell Industries N.V.; Marathon Petroleum Corporation; ONEOK, Inc.; PBF Energy Inc.; Targa Resources Corp.; The Williams Companies, Inc.; Valero Energy Corporation; Westlake Corporation.

CAPITAL STRUCTURE

CAPITAL SPENDING

PSX S&P 100 Peers* 21.6 21.5 42% 38% ($ in billions) 15.9 14.4 40% 34% 2022 2020 2021 3.1 2.5 Growth Sustaining ($ in billions) 2.2 2.9 1.9 2022 2020 2021

34.1 17.2 6.1 34% 24%

$2 billion Growth Sustaining Approximately 50% of growth capital supports lower-carbon opportunities 2023 CONSOLIDATED CAPITAL

Adjusted Return on Capital Employed (%) 9 22 1 2022 2020 2021 ADJUSTED ROCE Equity Debt Cash and cash equivalents Debt-to-capital Net debt-to-capital Feb-23 Adjusted ROCE and net debt-to-capital are non-GAAP financial measures. See appendix for more information and a reconciliation to the nearest GAAP financial measures. 12% May-22 May-21 May-20 May-19 May-18 May-17 May-16 May-15 May-14 May-13 May-12 -20% 20% 60% 100% 140% 180% 220% 160% 300% 340% 380% 7 FINANCIAL HIGHLIGHTS 2012 - 2022 average adjusted ROCE

BUDGET

Operating Excellence Growth Returns Distributions High-Performing Organization Integrated Portfolio C2G Pipeline BRAZORIA, TX Strategy 8 PHILLIPS 66 2022 YEAR IN REVIEW STRATEGY LEADERSHIP FINANCIAL HIGHLIGHTS APPENDIX

LETTER FROM OUR PRESIDENT AND CEO

Our strategy has a proven track record of delivering long-term value.

OPERATING EXCELLENCE

Committed to safety, environmental stewardship, sustainability, reliability and cost efficiency while protecting shareholder value

GROWTH

Enhancing our portfolio by growing our integrated Midstream and Chemicals businesses, as well as executing our returns-focused lower-carbon strategy in Emerging Energy

RETURNS

Improving returns by investing to optimize and enhance existing assets

DISTRIBUTIONS

Committed to maintaining our financial strength and disciplined capital allocation to reward shareholders through continued dividend growth and share repurchases

HIGH-PERFORMING ORGANIZATION

Building capability, pursuing excellence and doing the right thing

9 STRATEGY

APPENDIX STRATEGY LETTER FROM OUR PRESIDENT AND CEO FINANCIAL HIGHLIGHTS

Strategic Priorities in Action

At our Investor Day in November 2022, we outlined the following strategic priorities that will enable us to reward Phillips 66 shareholders in the near and long term:

Deliver Shareholder Returns of $10 billion to $12 billion through dividends and share repurchases from July 2022 through year-end 2024.

Improve Refining Performance by increasing market capture and crude capacity availability, as well as reducing operating costs by $0.75/barrel annually.

Capture Value From Wellhead to Market as the DCP Midstream transactions are expected to add an incremental $1.3 billion adjusted EBITDA1, including commercial and operating synergies.

Execute Our Business Transformation targeting sustainable savings of $1 billion annually, including $800 million in cost reductions and $200 million in lower sustaining capital.

Maintain Financial Strength and Flexibility through delivering expected midcycle adjusted EBITDA growth of $3 billion by 2025, prioritizing our strong investment-grade credit ratings and targeting a 25-30% net debt-to-capital ratio.

Drive Disciplined Growth and Returns through disciplined capital allocation. Our ability to deliver secure, competitive and growing shareholder distributions in the future will be enabled by pursuing selective, returns-focused growth today.

WEB-EXCLUSIVE

Phillips 66 Investor Day 2022

Operating Excellence Growth Returns Distributions High-Performing Organization Integrated Portfolio 1See appendix for footnote. Adjusted EBITDA is a non-GAAP financial measure. See appendix for more information and a reconciliation to the nearest GAAP financial measure.

10 PHILLIPS 66 2022 YEAR IN REVIEW

LEADERSHIP

Our Businesses

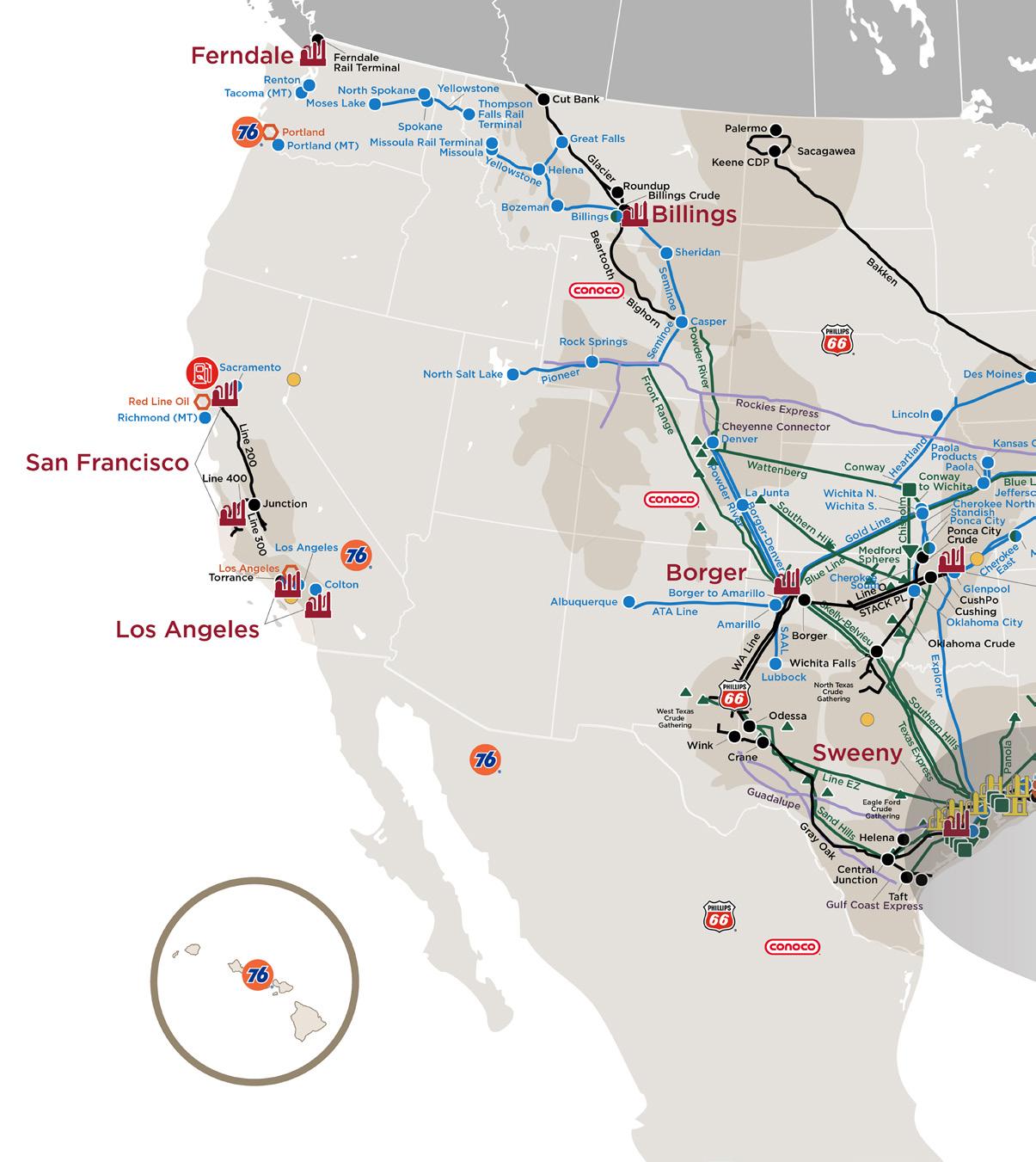

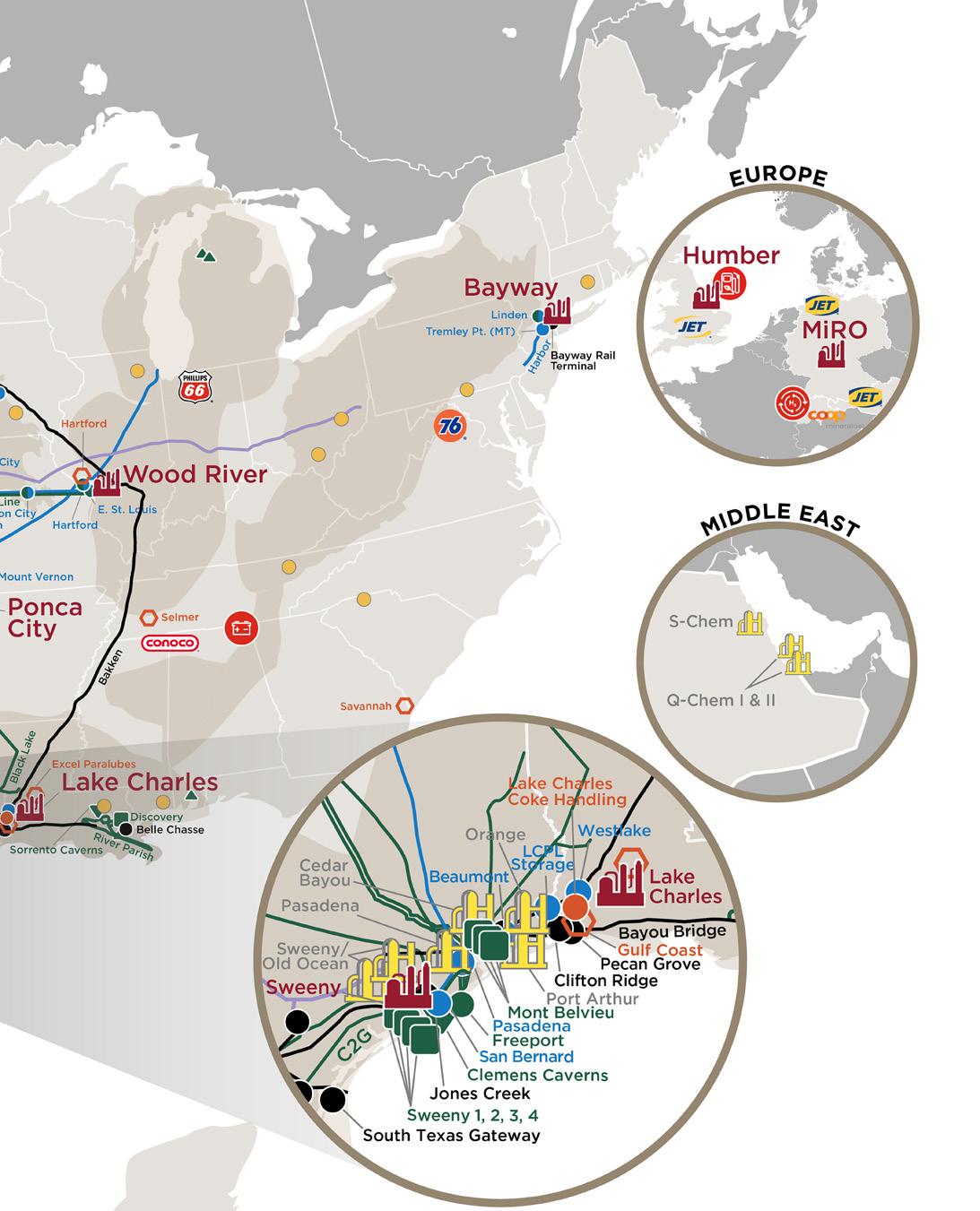

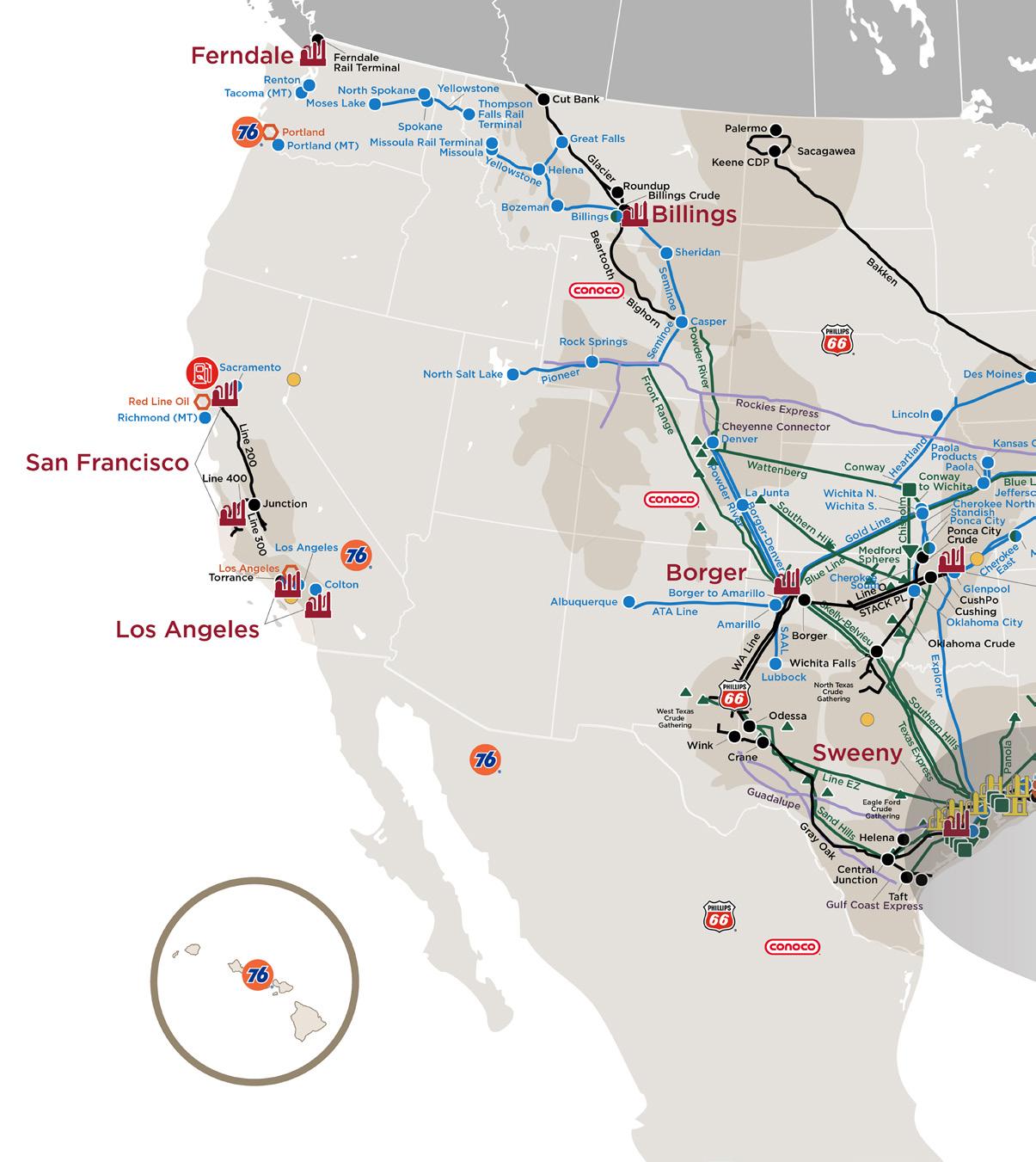

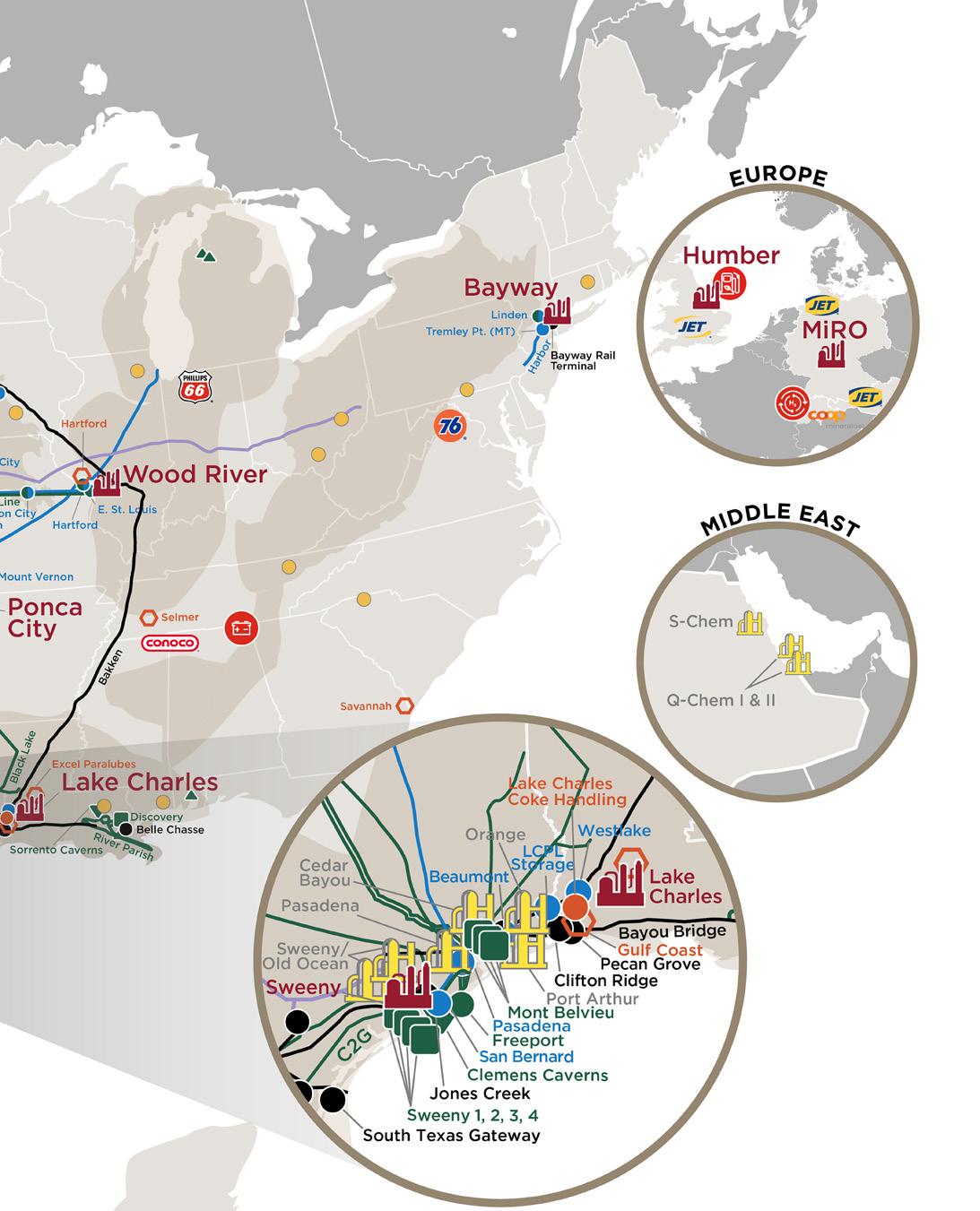

We have an integrated network of businesses and assets across the energy manufacturing value chain. Our diverse portfolio positions us well to create value through the market cycles.

MIDSTREAM

Our Midstream business provides crude oil and refined petroleum product transportation, terminaling and processing services, as well as natural gas and NGL transportation, storage, fractionation, gathering and processing, and marketing services, mainly in the United States. This segment includes DCP Midstream, LLC (DCP Midstream) and our 16% investment in NOVONIX Limited (NOVONIX).

CHEMICALS

Our 50% equity investment in CPChem, which manufactures and markets petrochemicals and plastics worldwide, is the basis for our Chemicals business. CPChem has cost-advantaged assets concentrated in North America and the Middle East.

WEB-EXCLUSIVE VIDEO Phillips 66’s Integrated Value Chain

72,000 miles of U.S. pipeline systems

719,000

BPD of fractionation capacity

5.5

BCFD of natural gas processing

28

global manufacturing facilities

2 research and development centers in the U.S.

REFINING

Our 12 refineries in the United States and Europe refine crude oil and other feedstocks into petroleum products, such as gasoline, distillates, aviation fuels and renewable fuels. Our Refining business focuses on operating excellence and margin enhancement.

MARKETING AND SPECIALTIES

We market refined petroleum products, mainly in the United States and Europe. This segment includes the manufacturing and marketing of specialty products, such as base oils and lubricants.

1.9 million

BPD of crude throughput capacity

7,200 branded U.S. outlets

1,670 branded international outlets

As of Jan. 1, 2023

11 STRATEGY

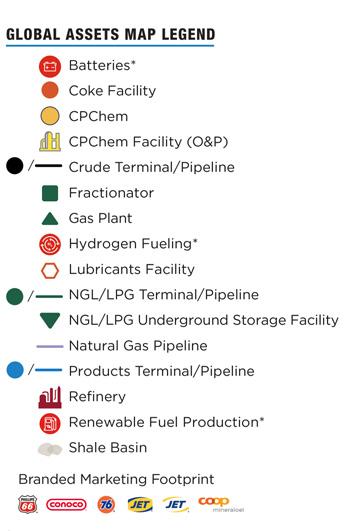

Operating Excellence Growth Returns Distributions High-Performing Organization Integrated Portfolio As of Dec. 31, 2022 *Includes Emerging Energy opportunities projected to begin in marked locations **Belle Chasse Terminal held for sale 12 PHILLIPS 66 2022 YEAR IN REVIEW

LETTER FROM OUR PRESIDENT AND CEO

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

** 13 STRATEGY

Our 2022 combined workforce total recordable rate of 0.11 is 30 times better than the 2021 U.S. average manufacturing facility rate of 3.3. Our lost workday case rate was 0.02 last year, approximately 15 times better than the 2021 U.S. refining average, and our Tier 1 and 2 combined process safety event rate was 0.13, nearly half the 2021 U.S. refining average.

Using digital technology helps us optimize our operations and transforms how we think about our business. We leverage data analytics, machine learning and artificial intelligence to elevate our operational performance, enhance asset reliability and make quicker, more informed decisions.

In Refining, we achieved 90% crude capacity utilization. We are committed to cost discipline and consistently participate in industry benchmarking to maintain our competitive cost structure.

In Midstream, we are focused on the reliability and integrity of our gas plants, pipelines, terminals and fractionators. In 2022, the Freeport LPG Export Terminal loaded a record 253,000 barrels per day (BPD). The Sweeny Hub fractionation complex averaged 465,000 BPD, reaching record rates. With the completion of Frac 4, Sweeny became the second-largest fractionation hub in the U.S.

In Chemicals, CPChem demonstrates reliability by consistently operating at rates better than the industry average. In 2022, CPChem’s global olefins and polyolefins (O&P) capacity utilization rate was 91%.

CPChem and its employees focus on safe, reliable operations, committing to the highest standards in operating excellence. CPChem achieved a total recordable rate of 0.12, more than 16 times better than the industry average, and zero Tier 1 process safety events.

253,000

Operating Excellence Integrated Portfolio Growth Returns Distributions High-Performing Organization 84 2021 76 2020

2020 utilization impacted by significant loss of product demand due to COVID-19 pandemic. 2021 utilization impacted by severe winter storms on the U.S. Gulf Coast in 1Q 2021; excludes Alliance Refinery beginning in 4Q 2021.

14 PHILLIPS 66 2022 YEAR IN REVIEW

90 2022 (%)

Industry Average (Incidents per 200,000 hours worked) TOTAL RECORDABLE

Sources: Industry averages from American Fuel & Petrochemical Manufacturers and Gas Processors Association Phillips 66 CPChem

REFINING CRUDE CAPACITY UTILIZATION 0.65 DCP Midstream

RATES 0.32 0.11 2022

0.12

0.35 0.11 2020 2021

0.41 0.12 2022

0.38 0.05 2020

0.10 2021

0.55 0.34 2022

0.37 2020

0.33 2021

Operating Excellence

We’re committed to safety, environmental stewardship, sustainability, reliability and cost efficiency while protecting shareholder value.

Operating excellence is foundational to everything we do, and safety is core to who we are. By prioritizing operating excellence, we are creating value for our shareholders. We have a robust health, safety and environmental program and strive toward a zero-incident, zero-injury workplace.

BPD loaded at the Freeport LPG Export Terminal

LETTER FROM OUR PRESIDENT AND CEO LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

Operations Earn High Safety Honors

In 2022, American Fuel & Petrochemical Manufacturers recognized three Phillips 66 refineries for exemplary safety performance, and, for the sixth straight year, one of our refineries was awarded best in class in safety.

The Sweeny Refinery received the Distinguished Safety Award, which is the highest annual safety award the industry recognizes. The Billings Refinery received the second-highest recognition, the Elite Gold Award, and the Bayway Refinery earned an Elite Silver Award for top 10 percentile safety performance. CPChem received an Elite Gold and Elite Silver for two of its sites.

In Midstream, Phillips 66 was awarded the American Petroleum Institute large operator Distinguished Pipeline Safety Award for the second consecutive year. In addition, the company received the Platinum Safety Award in the large-company division from the International Liquid Terminals Association.

All manufacturing Construction Petrochemical manufacturing Petroleum refineries Phillips 66 Professional and business services Agriculture crop production Bayway Refinery LINDEN, NJ

0.11

15 STRATEGY Sources: Bureau of Labor Statistics, 2021 data; Phillips 66, 2022 data Food manufacturing 5 4 3 2 1 0 Average of all U.S. industries, including private companies and state and local governments (Incidents per 200,000 hours worked) TOTAL RECORDABLE RATE BY INDUSTRY

For the sixth straight year, a Phillips 66 refinery is best in class in safety.

ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Sustainability shapes how we define and execute our strategy, which supports our long-term resilience and competitiveness.

We are committed to strong ESG principles and to our shareholders, our people and the communities in which we operate and where we work. Prioritizing sustainability positions Phillips 66 for long-term resiliency and creates shareholder value. It informs how we make decisions and how we interact with our communities.

We are guided by our sustainability pillars of environmental stewardship, social responsibility and governance, as well as operating excellence and financial performance. These pillars ensure we have a thriving business today and in the future.

Oversight and Ethics

Our board of directors’ Public Policy and Sustainability Committee oversees our sustainability programs. The board’s oversight of our strategy, understanding of risk, and appreciation of how technology and innovation shape our future provides long-term value.

Our Code of Business Ethics and Conduct guides our actions to ensure the highest level of responsibility, integrity and compliance. We have robust policies and audits that provide strong governance within the company and across our supply chains.

Our Sustainability Report highlights our key successes within our sustainability pillars. It also provides enhanced disclosures and transparency of critical performance data. Our Human Capital Management Report provides insight into the company’s culture, workforce metrics and benefits. Additionally, our Lobbying Activities Report details our climate position and principles, as well as alignment with trade associations.

CPChem Sustainability

CPChem is taking steps across its value chain to deploy solutions for a lower-carbon future. In 2022, CPChem established a 2030 target to reduce the Scope 1 and Scope 2 carbon intensity of its operations by 15% relative to a 2020 baseline.

CPChem is developing a circular economy for its products. It is the first company in the United States to announce commercial-scale production of circular polyethylene, including an annual production target of 1 billion pounds of Marlex® Anew™ Circular Polyethylene by 2030. CPChem is a founding member of the Alliance to End Plastic Waste and a member of Operation Clean Sweep Blue, a campaign dedicated to keeping pellets out of the environment.

Operating Excellence Integrated Portfolio Growth Returns Distributions High-Performing Organization

Operating Excellence Integrated Portfolio Growth Returns Distributions High-Performing Organization

CPChem is working to support a circular economy for its products.

CPChem ethylene unit at Cedar Bayou BAYTOWN, TX

LETTER FROM OUR PRESIDENT AND CEO LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

Our Greenhouse Gas Emissions Reduction Targets

We support the goals of the Paris Agreement and are committed to being a part of the solution to help the world address climate change.

We have set measurable, impactful and attainable targets for GHG emissions intensity reductions for 2030 and 2050, both from a 2019 baseline. The targets build on our strategy to improve the energy efficiency of our current assets and invest in new energy technologies. Our Emerging Energy organization continues to advance lowercarbon opportunities in renewable fuels and other energy technologies. Our emissions targets are aligned with our strategy and consistent with the company’s disciplined approach to capital allocation and focus on returns.

Emissions Intensity Reduction Targets

30%

Manufacturing-related emissions intensity

Scope 1 and 2 from operated assets by 2030

15%

Product-related emissions intensity

Scope 3 from products manufactured and sold by 2030

50%

Manufacturing-related emissions intensity

Scope 1 and 2 from operated assets by 2050

Read more on our GHG emissions reduction targets and find additional sustainability metrics and disclosures in the sustainability section of our website.

AT A GLANCE

17 STRATEGY

Unit 250 renewable diesel at San Francisco Refinery RODEO, CA

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

ENERGY RESEARCH & INNOVATION

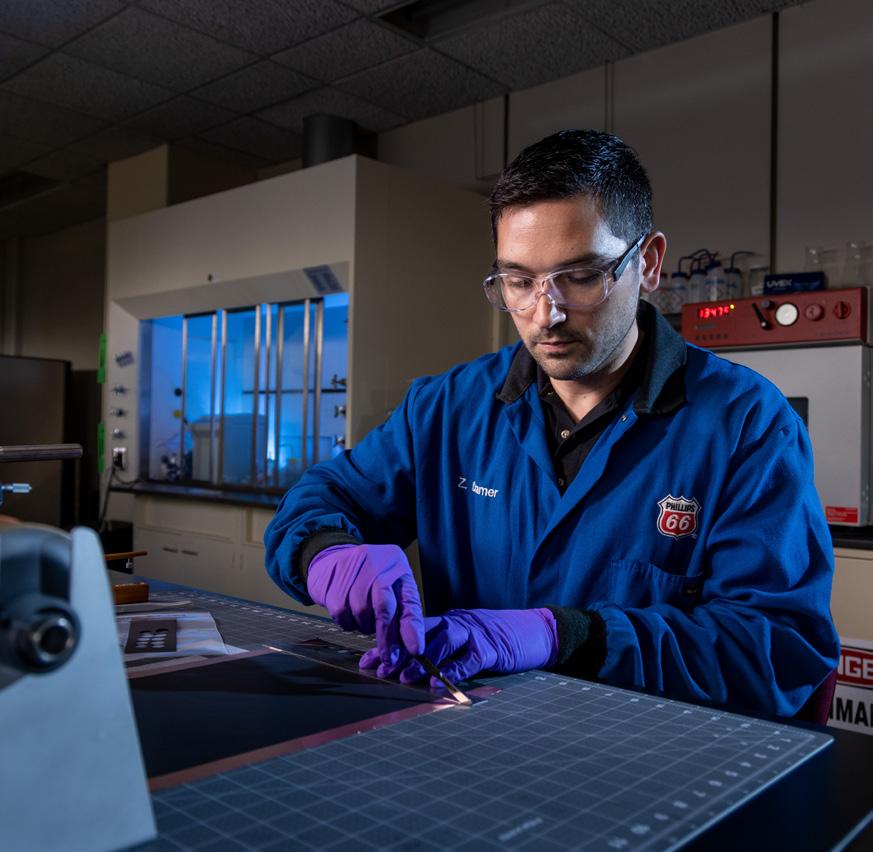

We are unique among downstream energy companies as one of the few with an in-house organization that performs industry-leading research and development.

We are on the cutting edge of research to advance our operations to be more sustainable and reduce our overall carbon footprint. We are turning ideas into action by developing technologies that will enable us to be first in class among clean, sustainable and reliable energy producers for many years to come. Energy Research & Innovation’s work includes:

• Novel carbon capture technologies.

• Lower-carbon hydrogen production.

• Renewable fuels processing technologies.

• Next-generation battery technologies and partnership models.

517

active patents in 22 countries worldwide, including:

• Specialty carbon.

• Premium coke.

• Lower-carbon hydrogen.

• Carbon capture and sequestration.

• Biofuels.

200+ labs with technicians, Ph.D. scientists and engineers

Operating Excellence Integrated Portfolio Growth Returns Distributions High-Performing Organization As of Dec. 31, 2022

Batteries laboratory at the Phillips 66 Research Center BARTLESVILLE, OK

LETTER FROM OUR PRESIDENT AND CEO

Unlocking Value With a Wellhead-to-Market NGL Strategy

Tim Roberts, Executive Vice President of Midstream and Chemicals, describes 2022 as a “foundational” year for the company’s already robust Midstream business, setting the stage for true transformation in 2023.

Why is now the time to grow and strengthen the NGL value chain?

As a company, we’ve regained our strong financial position post-pandemic. After an ambitious Midstream capital program over the last several years, we have focused on simplifying our business and building out our NGL value chain. We rolled up Phillips 66 Partners LP in early 2022 and then restructured our interest in DCP Midstream, which gave us controlling interest while creating a highly competitive wellhead-to-market NGL business. With the DCP Midstream transactions, we expect to generate significant cash flow to support returns to shareholders and reinvest in growth opportunities in the company. The macroenvironment supports the supply and demand story for natural gas and NGL. NGL production is growing at a faster pace than crude and is expected to grow by 1.3 million barrels per day over the next decade. As global economies mature, we will see continued petrochemical growth, supporting the increasing demand for advantaged U.S.-based natural gas and NGL. The fundamentals are constructive for those with an integrated NGL system, and NGL clearly present the best pathway for value creation and growth in the future. Our wellhead-to-market strategy creates stable and growing cash flow and gives us a competitive advantage against our peers.

How will the integration of DCP Midstream create opportunities in your Midstream business?

The DCP Midstream transactions will bring our economic interest to nearly 87% and are expected to add an incremental $1.3 billion adjusted EBITDA1, including commercial and operating synergies. The team fully understands the importance of a successful integration, which will improve our cost structure while creating value for our shareholders. Integrating DCP Midstream’s assets lets us capture the full economic value by moving the molecules through our system versus competitors’ systems. This integrated system will drive lower costs, improve reliability and provide optionality for producers. Plus, the transaction will allow us to leverage the best that both companies offer, including technology, talent, best practices, scale and culture.

What role does the Sweeny Hub play in the wellhead-to-market strategy?

The Sweeny Hub is a world-class NGL complex with fractionators, cavern storage and an export dock. We have pipeline connectivity to the domestic petrochemical industry and waterborne access to global LPG markets. We provide valuable optionality to customers who want an alternative to Mont Belvieu or the congested Houston Ship Channel. The Sweeny team commissioned Frac 4 in late 2022, and it has been running above design capacity since its startup, which is a remarkable achievement by our operations and project teams. With the DCP Midstream transactions, we have over 5 billion cubic feet per day of gas processing capacity that will be the backbone of our integrated Midstream system. But assets are only one part of the story. We have some of the best people in the industry, and they make our success possible.

1See appendix for footnote. Adjusted EBITDA is a non-GAAP financial measure. See appendix for more information and a reconciliation to the nearest GAAP financial measure. 19 STRATEGY LEADERSHIP INSIGHTS

Tim Roberts

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

Growth

We’re enhancing our portfolio by growing our integrated Midstream and Chemicals businesses and executing our returns-focused lower-carbon strategy in Emerging Energy.

MIDSTREAM

Our Midstream assets are highly integrated with our Refining, Marketing and Specialties, and Chemicals segments. Our business is focused on three primary areas: crude oil pipelines and terminals, products pipelines and terminals, and the NGL wellhead-to-market value chain.

The 2023 Midstream capital budget for growth will be directed toward enhancing our integrated NGL value chain from wellhead to market.

Sweeny Hub

Our Sweeny Hub is strategically located on the U.S. Gulf Coast, with access to domestic and international petrochemicals, fuels, and liquefied petroleum gas (LPG) markets. It is integrated with our Sweeny Refinery and offers world-class fractionation, cavern storage and export capability.

We completed Frac 4 in the third quarter of 2022, adding 150,000 BPD. Sweeny Hub’s total nameplate capacity is 550,000 BPD, making it the second-largest fractionation hub in the U.S. The fractionators are supported by long-term customer commitments and are integrated with our Sand Hills Pipeline delivering raw NGL.

The Freeport LPG Export Terminal leverages our fractionation, transportation and storage infrastructure to supply global petrochemical, heating and transportation markets.

DCP Midstream

DCP Midstream has a diversified portfolio of assets engaged in the business of gathering, processing, logistics and marketing of natural gas and NGL. DCP Midstream has 5.5 billion cubic feet per day (BCFD) of natural gas processing capacity and produces approximately 400,000 BPD of NGL. DCP Midstream’s network of assets includes 36 gas processing plants and approximately 55,000 miles of pipeline across liquids-rich basins, including the Permian Basin, the Eagle Ford and the DJ Basin.

In 2022, we realigned our economic and governance interests and assumed oversight and management of DCP Midstream. The realignment increased our economic interest from 28.3% to 43.3%. We also announced an agreement to acquire the public

WEB-EXCLUSIVE

News Release: Phillips 66 and DCP Midstream

common units, which will increase our economic interest to 86.8%. The transaction is expected to close in the second quarter of 2023.

The DCP Midstream assets expand our NGL footprint, increasing our operational size and scale. We are integrating DCP Midstream to unlock significant synergies and growth opportunities across our NGL wellhead-to-market value chain.

Bakken Pipeline System

The Bakken Pipeline system is one of the largest pipelines in our portfolio with 1,918 miles of pipeline and 750,000 BPD of shipping capacity. We have a 25% interest through two joint ventures in the pipeline system that transports crude oil from the Bakken/ Three Forks production area in North Dakota to Patoka, Illinois, and Nederland, Texas, including our Beaumont Terminal. These two pipeline systems collectively form the Bakken Pipeline system, which is operated by a co-venturer.

Beaumont Terminal

Our Beaumont Terminal in Nederland, Texas, is the largest in the Phillips 66 portfolio. It is strategically located on the U.S. Gulf Coast with connections to 12 crude oil pipelines and access to six refineries. The terminal has dock capacity of 800,000 BPD and total crude and product storage capacity of 16.8 million barrels.

Growth Operating Excellence Distributions High-Performing Organization Returns Integrated Portfolio

20 PHILLIPS 66 2022 YEAR IN REVIEW

LETTER FROM OUR PRESIDENT AND CEO

CHEMICALS

CPChem is one of the world’s top producers of olefins and polyolefins and a leading supplier of aromatics, alpha olefins, styrenics, specialty chemicals, plastic piping and polymer resins. In addition, the joint venture is the world’s second-largest producer of normal alpha olefins, with world-scale manufacturing facilities, proprietary technology and a feedstock-advantaged portfolio in North America and the Middle East.

CPChem is the number two global high-density polyethylene producer and a leader in licensing proprietary technology to make polyethylene.

Polyethylene sales volumes were strong in 2022, providing the building blocks for the products essential to modern life.

70,000+

consumer and industrial products are made from polyethylene

Our 50% share of CPChem’s 2023 capital budget is $925 million and is expected to be self-funded. CPChem is advancing high-return growth opportunities. This includes expansion of its normal alpha olefins business, adding a second worldscale unit to produce 1-hexene near the company’s Sweeny facility. In addition, CPChem is expanding its propylene splitting capacity by 1 billion pounds per year with a new unit located at its Cedar Bayou facility in Baytown, Texas. CPChem is also executing a portfolio of low-capital, high-return optimization and debottlenecking opportunities.

CPChem Growth is Domestic and International

CPChem and QatarEnergy are jointly building petrochemical facilities on the U.S. Gulf Coast and in Ras Laffan, Qatar.

On the U.S. Gulf Coast, the Golden Triangle Polymers facility will include a 4.6 billion pounds-per-year ethane cracker and two high-density polyethylene units with a combined capacity of 4.4 billion pounds per year. CPChem owns a 51% equity share in the joint venture, and QatarEnergy owns 49%. Operations are expected to begin in 2026.

The Ras Laffan Petrochemicals facility will include a 4.6 billion pounds-per-year ethane cracker and two high-density polyethylene units with a combined capacity of 3.7 billion pounds per year. The joint venture is owned 70% by QatarEnergy and 30% by CPChem. The plant is expected to start up in late 2026.

21

CPChem polyethylene unit OLD OCEAN, TX

STRATEGY

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

Emerging Energy

We are building a thriving growth platform to develop and advance our lower-carbon strategy. Our Emerging Energy organization is focused on lower-carbon opportunities that build on our existing strengths and asset footprint. As natural extensions of our business, these focus areas enable us to diversify the energy we provide and capture additional growth.

Our approach to implementing new technology is disciplined and returns-focused and leverages our core competencies, commercial expertise and leadership in research and innovation.

RENEWABLE FUELS

Renewable fuels like renewable diesel, sustainable aviation fuel (SAF) and renewable naphtha are an extension of our current business and allow us to use existing infrastructure in new ways to meet changing energy needs. Additionally, processing pyrolysis oil from waste plastics allows us to make feedstocks for new plastics.

Phillips 66 is also investing in additional energy technologies as strategic complements to our core businesses.

BATTERIES

As a leading manufacturer of specialty coke, a precursor material to synthetic graphite used in batteries for electronics and electric vehicles (EVs), we are an important part of the U.S. and European battery value chain.

CARBON CAPTURE

Carbon capture is a critical part of meeting climate goals. It’s why we’re part of a consortium of Houston companies working to capture and store carbon dioxide.

HYDROGEN

Hydrogen is a low-emission fuel that will help decarbonize sectors that are hard to electrify, like heavy industry.

EV CHARGING

We’re aligning with leading technology companies to bring EV charging to U.S. and European consumers.

Growth Operating Excellence Distributions High-Performing Organization Returns Integrated Portfolio

22 PHILLIPS 66 2022 YEAR IN REVIEW

We are leveraging our existing capabilities and advancing investments in new energy technologies.

LETTER FROM OUR PRESIDENT AND CEO

76® renewable diesel service station PLEASANT HILL, CA

WEB-EXCLUSIVE

Our efforts to achieve a lower-carbon future in the United Kingdom

Pursuing a Lower-Carbon Future

We are investing in growth opportunities and securing strategic partnerships that advance solutions for the future by:

• Advancing the Rodeo Renewed project to produce an initial 800 million gallons per year (over 50,000 BPD) of renewable transportation fuels, including renewable diesel, renewable gasoline and SAF by early 2024.

• Increasing marketing of lowercarbon fuels on the U.S. West Coast.

• Producing lower-carbon fuels at the Humber Refinery, and the first U.K. refinery to produce SAF at scale, supplying it to British Airways.

• Securing renewable fuels feedstock supply, including through investment in the Shell Rock Soy Processing facility in Iowa.

• Evaluating solar and wind energy to power our pipelines and refineries and the feasibility of carbon capture from our operations.

• Achieving International Sustainability and Carbon Certification (ISCC) PLUS certification at the Sweeny Refinery in Texas to process oil from waste plastics into feedstocks for new plastics.

• Building on our strategic investment in NOVONIX through a technology development agreement to advance the production and commercialization of nextgeneration anode materials for lithium-ion batteries.

• Aligning with leading technology companies to offer EV charging to our consumers in the U.S. and Europe. In 2022, we announced plans with FreeWire Technologies to deploy its ultrafast, batteryintegrated technology by leveraging our U.S. branded network.

• Operating hydrogen fueling sites in Switzerland through our Coop joint venture. In 2022, we formed the JET H2 Energy joint venture to develop hydrogen refueling stations in Germany, Austria and Denmark.

• Progressing industrial-scale renewable hydrogen at the Humber Refinery as part of the Gigastack project.

Used cooking oil unit at Humber Refinery NORTH LINCOLNSHIRE, U.K.

23 STRATEGY

LETTER FROM OUR PRESIDENT AND CEO

Returns

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

We are improving returns by investing to optimize and enhance existing assets.

REFINING

We are focused on improving our Refining performance to ensure reliability, increase market capture and reduce costs. In 2022, Refining financial performance was strong, supported by favorable market conditions driven by tight global product supply and demand balances. Our employees are committed to reliable operations to provide critical energy products to the world.

Our Refining assets are some of the most competitive in the industry. Their integration with our other businesses provides us with flexibility and optionality. We seek opportunities to enhance margins and focus on the cost structure of our refineries to ensure long-term competitiveness.

We also strengthen returns by improving yields of higher-value products and increasing the throughput of advantaged feedstocks. We process a diversified crude slate that is approximately one-third each of light, medium and heavy grades. Our Value Chain Optimization organization maximizes opportunities across our integrated system.

In 2022, Refining had a clean product yield of 84%, including a distillate yield of 38%.

84% clean product yield

38% distillate yield

The 2023 Refining capital budget will be directed toward converting the San Francisco Refinery as part of the Rodeo Renewed project, sustaining our assets and executing high-return, low-capital projects to improve asset reliability and market capture.

Operating Excellence Growth Returns Distributions High-Performing Organization

Integrating our Refining system with our other businesses provides flexibility and optionality.

Integrated Portfolio

Billings Refinery BILLINGS,

MT

LEADERSHIP INSIGHTS

A Look at Our Business Transformation Program

David Erfert has made a career of driving improvements and significant change. He was tasked to lead another mission in 2022 as Phillips 66’s Chief Transformation Officer, responsible for delivering an expected $1 billion in savings annually on a sustainable basis.

What was the rationale for Phillips 66’s Business Transformation program?

We’re living in a world of accelerating change that has disrupted the way many companies operate. Embracing technology improvements will lead to a more competitive portfolio. We’re transforming to a lower-cost, more profitable, more sustainable business model to deliver an expected $1 billion in run-rate savings by the end of 2023. Business Transformation is enabling us to compete and win as energy markets evolve. The leadership team challenged our high-performing organization to improve how we work, to be more agile and to maximize resources by leveraging technology.

What has Phillips 66 achieved so far in its transformation initiatives?

The leadership team and our employees are committed to delivering these results. Employees across the organization generated more than 3,000 ideas to drive efficiency and value. We evaluated those ideas, and more than 500 are in place and delivering value or are positioned to deliver value. Initiatives range from increasing our use of rejuvenated catalysts at our refineries, which have a lower cost but similar performance to new catalysts, to establishing new commercial processes to reduce shipping delays and enhance data visibility. And it’s not just operational improvements; it’s organizational, too. We’ve further enhanced our centralized model for core functions like Finance, Procurement, IT and Capital Projects to drive consistency and reduce redundancies across the company. Redesigning our organization led to a significant portion of our cost reductions. In 2022, our employee base was reduced from approximately 14,000 to 13,000. We’re also utilizing digital capabilities across the enterprise to improve automation and reduce costs.

We ended 2022 at over $500 million in run-rate savings, including $200 million in sustaining capital and over $300 million in cost. I’m extremely impressed by what the organization accomplished last year, and it’s a testament to our leadership, our employees and our culture of excellence.

What’s on the horizon for Business Transformation in 2023?

We experienced significant change in 2022, and it’s important that we embrace those changes in 2023. We have some big initiatives to drive to the bottom line and hit our cost targets, and I’m confident we will get the job done. We continue to generate new ideas, extract more value and involve more employees to gain new perspectives. For transformation to really take hold long term, we must adopt the behaviors that allow us to maintain our new ways of working. We’ll continue to build upon our strong culture in 2023, and we look forward to what’s ahead for Phillips 66.

David Erfert

25 STRATEGY

Operating Excellence Growth Returns Distributions High-Performing Organization Integrated Portfolio 26 PHILLIPS 66 2022 YEAR IN REVIEW

Conoco® fuel station WEATHERFORD, OK

LETTER FROM OUR PRESIDENT AND CEO

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

MARKETING AND SPECIALTIES

Marketing and Specialties is a high-return, low-capital business that provided strong cash generation in 2022. Our Marketing business supports placement of our products, providing optionality and incremental value generation.

We are focused on increasing placement of traditional and renewable fuels to end users to capture greater value. Additionally, we are pursuing hydrogen and EV charging opportunities across our networks.

U.S. Marketing

We market fuels through outlets with the Phillips 66®, Conoco® or 76® brands and through unbranded channels. Our network provides integration with our Refining assets, ensuring placement, particularly in the U.S. Central and West Coast regions. The strength of our brands is also reflected by the 1,330 sites covered by brand-licensing agreements.

7,200 branded outlets

5,100 outlets utilized by our wholesale network of marketers

950 joint venture outlets

600 branded retail sites in California sell renewable diesel

In the United States, we had approximately 7,200 branded outlets in 48 states and Puerto Rico at the end of 2022. In California, approximately 600 branded retail sites sell renewable diesel. Our wholesale operations utilize a network of marketers operating approximately 5,100 outlets. We place a strong emphasis on the wholesale channel of trade because of its low capital requirements and ability to provide secure off-take from our refineries.

In addition, we are engaged in retail joint ventures in the United States. This aligns with our strategy to secure long-term placement of our refinery production and extend participation in the retail value chain. At the end of 2022, our joint ventures had approximately 950 outlets.

We are bringing ultrafast EV charging to consumers through an agreement with FreeWire Technologies, with the first chargers installed in 2022 at our flagship Phillips 66 fuel station near our Houston headquarters.

STRATEGY 27

WEB-EXCLUSIVE Ultrafast EV charging debuts at Phillips 66 flagship station EV chargers at Phillips 66 flagship site HOUSTON, TX

International Marketing

We are an industry leader with a proven low-cost, high-volume approach, demonstrated by the strong market share of our branded retail businesses.

We market retail and wholesale products in Austria, Germany and the United Kingdom under the JET® brand. In Switzerland, we market refined products through a joint venture under the Coop brand name and are also operating and adding hydrogen stations. During 2022, we completed the formation of a 50-50 joint venture with H2 Energy Europe to set up and operate a network of up to 250 hydrogen retail refueling stations across Germany, Austria and Denmark by 2026.

1,270

330

At the end of 2022, we had approximately 1,270 marketing outlets in Europe and 330 additional sites through our Coop joint venture in Switzerland, and we held brand-licensing agreements covering approximately 70 sites in Mexico.

Specialties

In the Specialties business, we market finished lubricants under our premium Phillips 66®, Kendall® and Red Line® brands, as well as other private-label brands. We are a leading lubricants manufacturer in the United States and consistently receive high industry rankings for supplier satisfaction. Our strategy is to grow volumes through the marketer business in the U.S. and around the globe, focusing on premium product offerings across the commercial, industrial and automotive segments.

The Excel Paralubes joint venture, located adjacent to our Lake Charles Manufacturing Complex in Louisiana, is an integrated manufacturing and marketing business that provides our customers with high-quality base oil solutions. We own a 50% interest in the joint venture and are also the operator.

marketing outlets in Europe

Operating Excellence Growth Returns Distributions High-Performing Organization Integrated Portfolio FINANCIAL HIGHLIGHTS 28 PHILLIPS 66 2022 YEAR IN REVIEW

Coop joint venture sites in Switzerland

LEADERSHIP APPENDIX STRATEGY

Phillips 66 Lubricants Guardol assembly line at Hartford Lubricants facility HARTFORD, IL

LETTER FROM OUR PRESIDENT AND CEO

STRATEGY 29

JET U.K. Humber flagship petrol station NORTH LINCOLNSHIRE, U.K.

Distributions

Phillips 66 will continue to deliver value for shareholders through a secure, competitive and growing dividend and share repurchases.

We prioritize distributions to our shareholders, and during 2022, we paid $1.8 billion in dividends and increased the quarterly dividend to $0.97 per share. In February 2023, we further increased our quarterly dividend by 8% to $1.05 per share.

In 2022, we also resumed our share repurchase program. Share repurchases were $1.5 billion. Since the company formed in 2012, we have returned $33 billion through dividends, share repurchases and exchanges. We have reduced our original shares outstanding by 26%.

Distributions Number of shares outstanding Cumulative shareholder distributions* (Annual $/share) SHARE COUNT AND DISTRIBUTIONS DIVIDEND GROWTH 18% dividend compound annual growth rate (CAGR) Integrated Portfolio Operating Excellence Growth High-Performing Organization Returns 18% CAGR 2.18 3.10 3.50 3.60 3.62 3.83 1.33 2.45 1.89 2.73 2015 2018 2021 2022 2013 2016 2019 2014 2017 2020 *Through share repurchases, share exchanges and dividends 4Q 2013 4Q 2014 4Q 2015 4Q 2016 4Q 2017 4Q 2018 4Q 2019 4Q 2020 4Q 2021 4Q 2022 Total shareholder distributions: $33 billion 3Q 2012 466 million shares 626 million shares

30 PHILLIPS 66 2022 YEAR IN REVIEW

Sweeny Hub fractionators OLD OCEAN, TX

LETTER FROM OUR PRESIDENT AND CEO

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

Ponca City Refinery PONCA CITY, OK STRATEGY

LETTER FROM OUR PRESIDENT AND CEO

LEADERSHIP APPENDIX STRATEGY FINANCIAL HIGHLIGHTS

High-Performing Organization

We are committed to building capability, pursuing excellence and doing the right thing.

Our people consistently execute our vision of providing energy and improving lives. Our employees demonstrate our core values of safety, honor and commitment and exemplify the behaviors of Our Energy In Action that guide how we work together.

It will take bold, creative thinking to solve the energy challenges we face now and in the future. A diverse workforce functioning in an atmosphere of inclusivity unleashes those bold ideas and creativity and gives us a competitive advantage.

We continuously work to shape and strengthen our culture, building a workplace where inclusion and diversity thrive and everyone feels like they belong. Our Business Transformation initiatives enable our people to work in new, more innovative ways and challenge the status quo. Our employees contributed more than 3,000 ideas to capture value and are working collaboratively across the value chain to bring hundreds of those ideas to life as we strengthen our business for the future.

Our Human Capital Management Report provides a comprehensive look at our approach and includes workforce metrics, details on the employee experience and insight into the culture that makes Phillips 66 a premier workplace.

Learn more about our employee experience in the Human Capital Management Report.

High-Performing Organization Integrated Portfolio Operating Excellence Growth Returns Distributions Inclusion & Diversity Week celebration event HOUSTON, TX

Our people consistently execute our vision of providing energy and improving lives.

32 PHILLIPS 66 2022 YEAR IN REVIEW

WEB-EXCLUSIVE For I&D Week, a call to connect and celebrate

Social Impact

We create purposeful partnerships that inspire action, identify solutions to society’s greatest challenges and improve lives. We work to strengthen economic, social and environmental resilience and vitality in the communities where our employees live and work. Employees invest in our communities through volunteering and financial contributions.

Our social impact strategy is evolving for 2023, with enhanced focus areas for corporate giving, including education equity, the environment, safety and well-being, and social advancement.

WEB-EXCLUSIVE Social Impact Snapshot

Employee Volunteerism in Action

88,000 hours volunteered by 3,028 employees in 2022

680,000 employee volunteer hours with charitable and service organizations since 2012

$280 million

invested in our communities since 2012

We believe in being good neighbors. Our employee volunteer program, Good Energy, inspires our workforce to strengthen the vitality of their communities by giving back in meaningful ways. Here are just a few of our volunteer activities in 2022:

• Hosted a family literacy night and book giveaway, distributing 3,000 books to children.

• Hosted Household Hazardous Waste Day and collected more than 27 tons of waste.

• Assembled 4,500 Child Safety ID kits to be distributed at elementary schools by Crime Stoppers.

• Worked 685 volunteer project hours to complete a family home with Habitat for Humanity.

STRATEGY

Habitat for Humanity volunteer event HOUSTON, TX

33

Leadership

Executive Leadership Team

Board of Directors

Investor Day 2022 Closing Bell Ceremony at NYSE NEW YORK, NY

Executive Leadership Team

Board of Directors

Investor Day 2022 Closing Bell Ceremony at NYSE NEW YORK, NY

34 PHILLIPS 66 2022 YEAR IN REVIEW

STRATEGY LEADERSHIP APPENDIX

LETTER FROM OUR PRESIDENT AND CEO FINANCIAL HIGHLIGHTS

Our team is focused on rewarding shareholders.

LEADERSHIP

35

LETTER FROM OUR PRESIDENT AND CEO

Board of Directors

STRATEGY LEADERSHIP APPENDIX FINANCIAL HIGHLIGHTS

Executive Leadership Team

Board of Directors

As our company and energy markets evolve, so does our board. We continued to refresh and diversify our board in 2022, welcoming two new directors.

GREG C. GARLAND

Executive Chairman of Phillips 66

JULIE L. BUSHMAN

Former Executive Vice President of International Operations of 3M

GREGORY J. HAYES

Chairman and CEO of Raytheon Technologies Corporation

GARY K. ADAMS

Former Chief Advisor — Chemicals for IHS Markit

Member of the Audit and Finance Committee

Member of the Human Resources and Compensation Committee

Member of the Nominating and Governance Committee

Member of the Public Policy and Sustainability Committee

Member of the Executive Committee

As of Dec. 31, 2022

LISA A. DAVIS

Former member of the Managing Board of Siemens AG and CEO of Siemens Gas and Power

CHARLES M. HOLLEY

Former Executive Vice President and Chief Financial Officer of Walmart Inc.

36 PHILLIPS 66 2022 YEAR IN REVIEW

DENISE R. SINGLETON Executive Vice President, General Counsel and Secretary of WestRock Company

JOHN E. LOWE Former Senior Executive Advisor to Tudor, Pickering, Holt & Co.

GLENN F. TILTON Former Chairman and CEO of UAL Corporation

MARNA C. WHITTINGTON Former CEO of Allianz Global Investors Capital

DENISE L. RAMOS Former CEO, President and Director of ITT Inc.

DENISE R. SINGLETON Executive Vice President, General Counsel and Secretary of WestRock Company

JOHN E. LOWE Former Senior Executive Advisor to Tudor, Pickering, Holt & Co.

GLENN F. TILTON Former Chairman and CEO of UAL Corporation

MARNA C. WHITTINGTON Former CEO of Allianz Global Investors Capital

DENISE L. RAMOS Former CEO, President and Director of ITT Inc.

LEADERSHIP

DOUGLAS T. TERRESON Former Head of Energy Research at Evercore ISI

37

MARK LASHIER President and CEO of Phillips 66

LETTER FROM OUR PRESIDENT AND CEO

Board of Directors

STRATEGY LEADERSHIP APPENDIX FINANCIAL HIGHLIGHTS

Executive Leadership Team

Executive Leadership Team

In 2022, we added two external hires to our 12-member ELT, and six members of the team took on new or restructured roles.

of Feb. 28, 2023

As

TODD DENTON Senior Vice President, Health, Safety and Environment and Field Operations Support

MARK LASHIER President and CEO

JEFF DIETERT Vice President, Investor Relations

DAVID ERFERT Senior Vice President, Chief Transformation Officer

ZHANNA GOLODRYGA Executive Vice President, Emerging Energy and Sustainability

RICH HARBISON Executive Vice President, Refining

38 PHILLIPS 66 2022 YEAR IN REVIEW

TIM ROBERTS Executive Vice President, Midstream and Chemicals

VANESSA A. SUTHERLAND Executive Vice President, Government Affairs, General Counsel and Corporate Secretary

BRIAN MANDELL Executive Vice President, Marketing and Commercial

TANDRA PERKINS Senior Vice President, Chief Digital and Administrative Officer

KEVIN J. MITCHELL Executive Vice President, Chief Financial Officer

TIM ROBERTS Executive Vice President, Midstream and Chemicals

VANESSA A. SUTHERLAND Executive Vice President, Government Affairs, General Counsel and Corporate Secretary

BRIAN MANDELL Executive Vice President, Marketing and Commercial

TANDRA PERKINS Senior Vice President, Chief Digital and Administrative Officer

KEVIN J. MITCHELL Executive Vice President, Chief Financial Officer

LEADERSHIP 39

SONYA REED Senior Vice President, Chief Human Resources Officer

LEADERSHIP APPENDIX

Non-GAAP Reconciliations

USE OF NON-GAAP FINANCIAL INFORMATION

This report includes the terms “adjusted earnings,” “adjusted earnings per share,” “net debt-to-capital ratio,” “adjusted ROCE,” “sustaining capital” and “growth capital.” These are non-GAAP financial measures that are included to help facilitate comparisons of operating performance across periods and to help facilitate comparisons with other companies in our industry, by excluding items that do not reflect the core operating results of our businesses in the current period. Sustaining and growth capital is a component of total capital expenditures, which is the most directly comparably GAAP financial measure. Adjusted EBITDA, as used in this report, is a forward-looking non-GAAP financial measure. EBITDA is defined as estimated net income plus estimated net interest expense, income taxes, depreciation and amortization. Adjusted EBITDA is defined as estimated EBITDA plus the proportional share of selected equity affiliates’ estimated net interest expense, income taxes, depreciation and amortization less the portion of estimated adjusted EBITDA attributable to noncontrolling interests. Net income is the most directly comparable GAAP financial measure for the consolidated company. Adjusted EBITDA estimates depend on future levels of revenues and expenses, including amounts that will be attributable to noncontrolling interests, which are not reasonably estimable at this time. Accordingly, we cannot provide a reconciliation between projected adjusted EBITDA to consolidated net income or segment income before income taxes without unreasonable effort.

PHILLIPS 66 RECONCILIATION OF EARNINGS (LOSS) TO ADJUSTED EARNINGS (LOSS)

1) Costs related to the shutdown of the Alliance Refinery totaled $26 million, pre-tax, in 2022. Shutdown-related costs recorded in the Refining segment include charges for the disposal of materials and supplies of $20 million and asset retirements of $6 million recorded in depreciation and amortization expense. Costs related to the shutdown of the Alliance Refinery totaled $192 million, pre-tax, in 2021. Shutdown-related costs recorded in the Refining segment include charges for asset retirements of $91 million recorded in depreciation and amortization expense, and severance and other exit costs of $31 million. Shutdown-related costs in the Midstream segment include asset retirements of $70 million recorded in depreciation and amortization expense.

2) Costs related to restructuring totaled $177 million, pre-tax. $159 million related to Phillips 66’s multi-year business transformation initiatives, which include a held-for-sale asset impairment of $45 million. $18 million related to the integration of DCP Midstream, LP, of which $10 million was attributed to noncontrolling interests.

3) We generally tax effect taxable U.S.-based special items using a combined federal and state annual statutory income tax rate of approximately 25% beginning in 2018 and approximately 38% for periods prior to 2018. Taxable special items attributable to foreign locations likewise use a local statutory income tax rate. Nontaxable events reflect zero income tax. These events include, but are not limited to, most goodwill impairments, transactions legislatively exempt from income tax, transactions related to entities for which we have made an assertion that the undistributed earnings are permanently reinvested, or transactions occurring in jurisdictions with a valuation allowance.

4) YTD 2022 and YTD 2021 are based on adjusted weighted-average diluted shares outstanding of 473,728 thousand and 441,418 thousand, respectively. Other periods are based on the same weighted-average diluted shares outstanding as that used in the GAAP diluted earnings per share calculation. Income allocated to participating securities, if applicable, in the adjusted earnings per share calculation is the same as that used in the GAAP diluted earnings per share calculation.

PHILLIPS 66 CAPITAL EXPENDITURES AND INVESTMENTS

1) Includes 100% of DCP, Midstream, LLC, Class A Segment, DCP Sand Hills Pipeline, LLC, and DCP Southern Hills Pipeline, LLC, capital expenditures and investments.

2) Excludes non-cash finance leases of $7 million in Corporate and Other.

(Millions of Dollars Except as Indicated) 2022 2021 2020 Net income (loss) attributable to Phillips 66 $11,024 1,317 (3,975) Pre-tax adjustments: Impairments — 1,496 4,241 Impairments by equity affiliates 15 Pending claims and settlements (37) Certain tax impacts — (11) (14) Pension settlement expense 77 81 Hurricane-related costs (21) 45 43 Winter-storm-related costs — 51 Lower-of-cost-or-market inventory adjustments (55) Asset dispositions (93) Alliance shutdown-related costs1 26 192 Regulatory compliance costs 70 (88) Restructuring costs2 177 Merger transaction costs 13 Gain on consolidation (3,013) Tax impact of adjustments3 635 (420) (568) Other tax impacts (85) (15) Noncontrolling interests (10) (53) (5) Adjusted earnings (loss) $8,901 2,521 (382) Earnings (loss) per share of common stock (dollars) $23.27 2.97 (9.06) Adjusted earnings (loss) per share of common stock (dollars)4 $18.79 5.70 (0.89)

(Millions of Dollars) Numerator 2022 2021 2020 Average 2012-2022 Net income (loss) $11,391 1,594 (3,714) 3,851 After-tax interest expense 489 459 394 302 GAAP ROCE earnings (loss) 11,880 2,053 (3,320) 4,153 After-tax special items (2,113) 1,257 3,598 49 Adjusted ROCE earnings $9,767 3,310 278 4,202 (Millions of Dollars) Denominator GAAP average capital employed* $43,691 36,751 38,174 34,499 Discontinued operations (26) Adjusted average capital employed* $43,691 36,751 38,174 34,473 GAAP ROCE 27% 6% (9)% 12% Adjusted ROCE 22% 9% 1% 12% *Total equity plus debt. PHILLIPS 66 CAPITAL EXPENDITURES AND INVESTMENTS 2023 BUDGET (Millions of Dollars) Growth Sustaining Total Midstream1 $310 329 639 Refining 729 389 1,118 Marketing and Specialties 95 39 134 Corporate and Other2 108 108 Phillips 66 Consolidated $1,134 865 1,999

66 RECONCILIATION OF DEBT-TO-CAPITAL RATIO TO NET DEBT-TO-CAPITAL RATIO (Millions of Dollars Except as Indicated) 2022 2021 2020 Total Debt $17,190 14,448 15,893 Total Equity 34,106 21,637 21,523 Debt-to-Capital Ratio 34% 40% 42% Total Cash $6,133 3,147 2,514 Net Debt-to-Capital Ratio 24% 34% 38%

PHILLIPS 66 RECONCILIATION OF ROCE TO ADJUSTED ROCE

PHILLIPS

(Millions of Dollars) 2022 2021 2020 Growth $1,276 932 1,978 Sustaining 918 928 942 Phillips 66 capital expenditures and investments $2,194 1,860 2,920 40 PHILLIPS 66 2022 YEAR IN REVIEW

STRATEGY LETTER FROM OUR PRESIDENT AND CEO FINANCIAL HIGHLIGHTS

Shareholder Information

DIRECT STOCK PURCHASE AND DIVIDEND REINVESTMENT PLAN

Phillips 66’s Investor Services Program is a direct stock purchase and dividend reinvestment plan that offers shareholders a convenient way to buy additional shares and reinvest their common stock dividends. Purchases of company stock through direct cash payment are commission-free.

Please call Computershare to request an enrollment package: Toll-free number: 866-437-0009

Or enroll online at www.computershare.com/investor.

Registered shareholders can access important investor communications online and sign up to receive future shareholder materials electronically by going to www.computershare.com/investor and following the enrollment instructions.

PRINCIPAL AND REGISTERED OFFICES

Phillips 66

P.O. Box 421959

Houston, TX 77242-1959

251 Little Falls Drive

Wilmington, DE 19808

STOCK TRANSFER AGENT AND REGISTRAR

Computershare

150 Royall Street

Canton, MA 02021 www.computershare.com/investor

Information Requests

For information about dividends and certificates or to request a change of address form, shareholders may contact:

Computershare

P.O. Box 43006

Providence, RI 02940-3006

Toll-free number: 866-437-0009

Outside the U.S.: 201-680-6578

TDD for hearing impaired: 800-231-5469

TDD outside the U.S.: 201-680-6610 www.computershare.com/investor

Personnel in the following offices also can answer investors’ questions about the company:

Institutional Investors

800-624-6440

investorrelations@p66.com

Individual Investors

866-437-0009

web.queries@computershare.com

COMPLIANCE AND ETHICS

For guidance, to express concerns or to ask questions about compliance and ethics issues, contact the Phillips 66 Corporate Ethics Office:

Attn: Corporate Ethics Office

Phillips 66 2331 CityWest Blvd. Houston, TX 77042

Toll-free number available 24/7: 855-318-5390 ethics@p66.com www.phillips66.ethicspoint.com

INTERNET

www.phillips66.com

The website includes resources of interest to investors, including news releases and presentations to securities analysts; copies of the Phillips 66 Proxy Statement; reports to the U.S. Securities and Exchange Commission; and data on health, safety and environmental performance. Other websites with information on topics included in this report: www.cpchem.com www.dcpmidstream.com

DISCLOSURE STATEMENTS

“Phillips 66,” “the company,” “we,” “us” and “our” are used interchangeably in this report to refer to the businesses of Phillips 66 and its consolidated subsidiaries.

Phillips 66®, Conoco®, 76®, Kendall®, Red Line®, JET® and their respective logos are registered trademarks of Phillips 66 Company or a wholly owned subsidiary. Other names and logos mentioned herein are the trademarks of their respective owners.

FOOTNOTE

1DCP Midstream adjusted EBITDA assumes the acquisition of all outstanding public common units of DCP Midstream, LP, plus our increased economic interest in DCP Midstream as a result of the merger of DCP Midstream, LLC and Gray Oak Holdings, LLC, excluding the impact from decreased ownership in Gray Oak Pipeline.

23-0024_3 2023 © Phillips 66 Company. All rights reserved. APPENDIX 41

Operating Excellence Integrated Portfolio Growth Returns Distributions High-Performing Organization

Operating Excellence Integrated Portfolio Growth Returns Distributions High-Performing Organization

Executive Leadership Team

Board of Directors

Investor Day 2022 Closing Bell Ceremony at NYSE NEW YORK, NY

Executive Leadership Team

Board of Directors

Investor Day 2022 Closing Bell Ceremony at NYSE NEW YORK, NY

DENISE R. SINGLETON Executive Vice President, General Counsel and Secretary of WestRock Company

JOHN E. LOWE Former Senior Executive Advisor to Tudor, Pickering, Holt & Co.

GLENN F. TILTON Former Chairman and CEO of UAL Corporation

MARNA C. WHITTINGTON Former CEO of Allianz Global Investors Capital

DENISE L. RAMOS Former CEO, President and Director of ITT Inc.

DENISE R. SINGLETON Executive Vice President, General Counsel and Secretary of WestRock Company

JOHN E. LOWE Former Senior Executive Advisor to Tudor, Pickering, Holt & Co.

GLENN F. TILTON Former Chairman and CEO of UAL Corporation

MARNA C. WHITTINGTON Former CEO of Allianz Global Investors Capital

DENISE L. RAMOS Former CEO, President and Director of ITT Inc.

TIM ROBERTS Executive Vice President, Midstream and Chemicals

VANESSA A. SUTHERLAND Executive Vice President, Government Affairs, General Counsel and Corporate Secretary

BRIAN MANDELL Executive Vice President, Marketing and Commercial

TANDRA PERKINS Senior Vice President, Chief Digital and Administrative Officer

KEVIN J. MITCHELL Executive Vice President, Chief Financial Officer

TIM ROBERTS Executive Vice President, Midstream and Chemicals

VANESSA A. SUTHERLAND Executive Vice President, Government Affairs, General Counsel and Corporate Secretary

BRIAN MANDELL Executive Vice President, Marketing and Commercial

TANDRA PERKINS Senior Vice President, Chief Digital and Administrative Officer

KEVIN J. MITCHELL Executive Vice President, Chief Financial Officer